The asset-backed lending ecosystem is diverse, encompassing lenders who provide financing secured by various types of assets such as equipment, invoices, etc. Finanta’s solutions are designed to integrate seamlessly with this landscape, enhancing the capabilities of lending platforms and enabling tech companies alike.

Online and challenger banks face distinct challenges in commercial lending that Finanta can help solve.

Asset Valuation

Accurately valuing the collateral assets to determine loan amounts and manage risks.

Portfolio Diversification

Managing a diverse portfolio of asset-backed loans to minimize risk and maximize returns.

Funding and Liquidity

Securing funding and maintaining liquidity to support lending operations.

Regulatory Compliance

Navigating complex regulations specific to asset-backed lending.

Technological Integration

Incorporating advanced technologies to enhance lending offerings and streamline operations.

Our comprehensive suite of lending software is designed to empower new age financial institutions with cutting-edge tools for every aspect of commercial lending

Integrate Finanta’s solutions with existing platforms and fintech solutions for a cohesive lending experience.

Ensure compliance and mitigate operational risks with our tools designed specifically for asset-backed lenders.

Manage your diverse loan portfolio with our robust portfolio management system, enabling risk diversification and strategic decision-making.

Utilize Finanta’s advanced valuation tools to accurately assess the value of collateral assets.

Finanta’s cutting-edge commercial lending software is crafted to deliver a monumental shift in commercial lending operations of online and challenger banks. Our solution is designed to drive significant improvements across key metrics, ensuring your bank stays competitive and efficient in a rapidly evolving market

Make informed lending decisions with precise valuation of collateral assets.

Maintain financial stability with effective funding and liquidity management.

Achieve a balanced loan portfolio with managed risks and maximized returns.

Stay ahead of regulatory changes and reduce and compliance risks.

Streamline lending processes for faster and more secure transactions.

Optimize commercial loan origination for a 40% efficiency boost.

Achieve upto 72% reduction in cost overheads

Automate loan management for a powerful 55% increase in loan volumes.

Cut risk exposure by up to 33% with our advanced risk assessment tools.

Finanta revolutionizes loan origination by streamlining client inquiries and pre-qualification, while automating application processes for a global lending solutions.

Finanta transforms loan approvals by seamlessly compiling and presenting loan proposals using advanced digital tools for informed decision-making.

Finanta ensures impeccable compliance with automated KYC and anti-money laundering systems, adhering to regulatory and internal policies effortlessly.

Revitalize loan servicing with Finanta’s efficient fund disbursement, real-time payment monitoring, and enhanced customer support through a comprehensive digital approach.

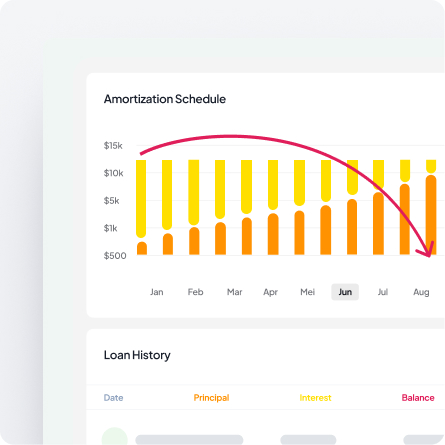

Finanta excels in loan portfolio management by offering advanced tools for performance monitoring, risk management, and adaptive portfolio restructuring.

Finanta secures assets and collateral through rigorous valuation and management, ensuring legal compliance and asset integrity throughout the loan term.

Finanta unlocks business insights with customizable reporting and advanced analytics, integrating with BI tools for comprehensive loan performance and market analysis.

Finanta amplifies lending operations with smart third-party integrations and fintech collaborations, leveraging advanced technologies for a competitive edge.

Finanta enables informed lending decisions through automated collateral valuation tools that assess various asset types—including accounts receivable, inventory, equipment, and invoices. The platform integrates with third-party valuation services, monitors collateral values in real-time, and applies dynamic advance rates based on asset quality and risk profiles. This precision ensures you’re lending the right amounts against current collateral values, reducing exposure while maximizing lending opportunities.

Finanta provides comprehensive funding and liquidity management tools specifically designed for the revolving nature of asset-based lending. The platform tracks borrowing base certificates, monitors availability calculations in real-time, manages reserve requirements, and provides visibility into funding commitments versus outstanding balances. This effective liquidity management maintains your financial stability while ensuring borrowers have timely access to funds as their collateral positions evolve.

Yes. Finanta’s platform is designed to manage diverse asset-backed lending portfolios, whether you’re financing against receivables, inventory, equipment, invoices, or multiple collateral types simultaneously. The system applies asset-specific valuation methodologies, advance rate structures, and monitoring requirements for each collateral type, ensuring a balanced portfolio with managed risks and maximized returns across your entire asset-based lending operation.