Understand the potential impact of Finanta’s commercial lending software on your business

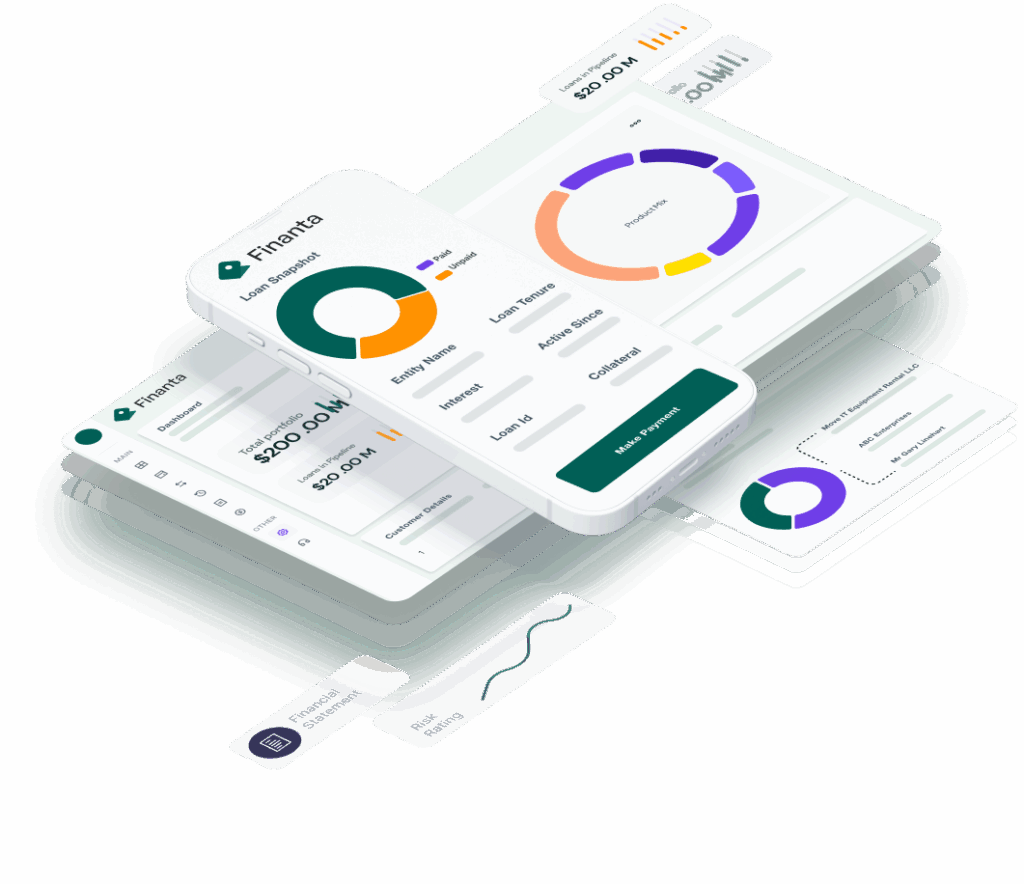

Finanta is committed to revolutionizing the commercial lending sector. Our robust suite of software solutions empowers lenders to navigate the complexities of the market, ensuring efficiency, compliance, and innovation at every stage of the lending process.

Process applications and generate reports with web-based accessibility for secure and efficient operations

Automate the entire lending application process from submission to booking and reporting

Gain a complete view of applicants for quality lending decisions, aggregating personal and business financial history

Elevate the borrower journey with intuitive interfaces, personalized communication, and seamless digital processes, ensuring a superior experience that fosters loyalty and satisfaction.

Accelerate credit decisions with Finanta’s Credit Risk Platform, enabling faster and more accurate analysis of financial data

Expand your reach with omni-channel portals for borrowers, brokers, and vendors, enhancing accessibility and convenience

Benefit from the security and flexibility of Finanta’s cloud-based solutions, ensuring seamless operations and data protection

Stay ahead of market trends and make informed decisions with our real-time market analysis tools.

Finanta’s commercial lending software is designed to address the critical challenges faced by lenders in the industry, providing comprehensive solutions that enable growth and innovation.

In the face of evolving regulations, Finanta provides a streamlined approach to regulatory compliance and reducing the risk of violations

Catering to lenders' infrastructure and security needs, Finanta ensures a cohesive lending experience, enabling smooth integration with fintech solutions

Finanta enables proactive risk mitigation and informed decision-making, helping lenders navigate the complexities of risk management in an increasingly competitive environment

Addressing the challenge of operational efficiency, Finanta streamlines lending processes with digital workflows and automated loan segregation while also reducing manual errors

Finanta tackles the challenge of data-driven decision-making by providing lenders with reporting and analytics tools, and a customer-centric approach.

Finanta revolutionizes loan origination by streamlining client inquiries and pre-qualification, while automating application processes for a global lending solutions.

Finanta transforms loan approvals by seamlessly compiling and presenting loan proposals using advanced digital tools for informed decision-making.

Finanta ensures impeccable compliance with automated KYC and anti-money laundering systems, adhering to regulatory and internal policies effortlessly.

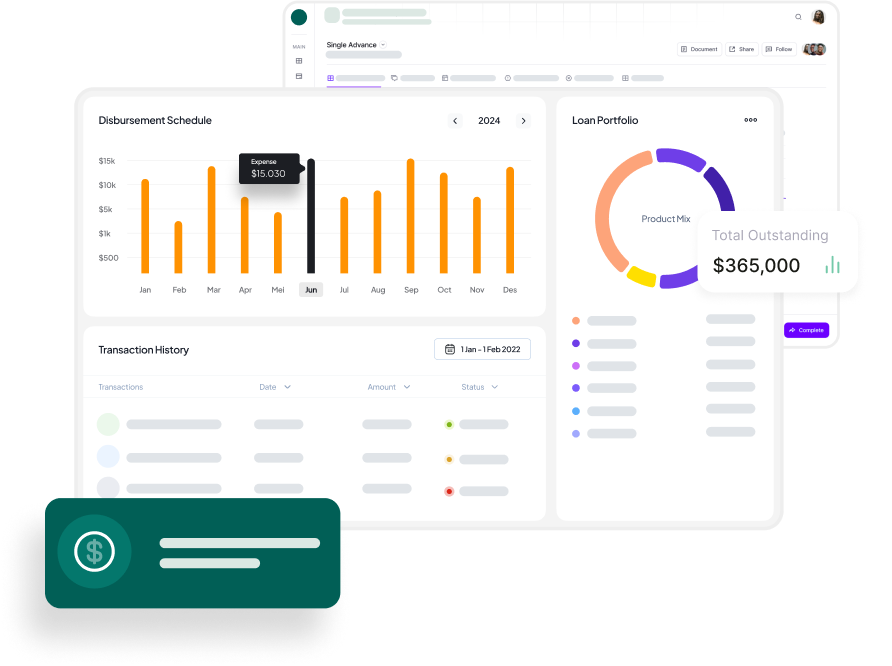

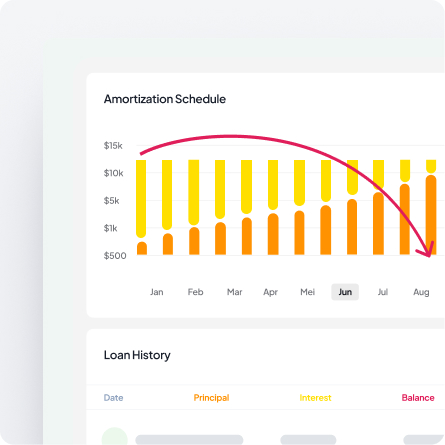

Revitalize loan servicing with Finanta’s efficient fund disbursement, real-time payment monitoring, and enhanced customer support through a comprehensive digital approach.

Finanta excels in loan portfolio management by offering advanced tools for performance monitoring, risk management, and adaptive portfolio restructuring.

Finanta secures assets and collateral through rigorous valuation and management, ensuring legal compliance and asset integrity throughout the loan term.

Finanta unlocks business insights with customizable reporting and advanced analytics, integrating with BI tools for comprehensive loan performance and market analysis.

Finanta amplifies lending operations with smart third-party integrations and fintech collaborations, leveraging advanced technologies for a competitive edge.

Community & Regional Banks

Credit Unions

Online & Challenger Banks

Commercial Real Estate Lenders

Equipment Leasing & Financing Companies

Asset-BackedLenders

Finanta enhances operational efficiency for community and regional banks with digital workflows and tailored loan products. Streamline lending operations and ensure competitiveness with our seamless system integration

Finanta revolutionizes lending for credit unions with a member-centric approach and digital transformation support. Elevate member engagement and offer competitive financial solutions with our comprehensive SaaS platform

Finanta supports online and challenger banks with innovative solutions like digital loan origination and real-time analytics. Stay ahead in the digital age with our advanced lending solutions and regulatory agility

Finanta provides commercial real estate lenders with advanced underwriting tools and market analysis capabilities. Simplify the lending process and make informed decisions with our sophisticated analytics

Finanta empowers equipment leasing and financing companies with accurate asset valuation tools and robust portfolio management systems. Optimize operations and enable risk diversification with our comprehensive lending software

Finanta addresses the challenges of asset- backed lenders with seamless technological integration and regulatory compliance tools. Ensure compliance and mitigate risks with our solutions designed specifically for asset-backed lending