Crafting efficient, auditable lending operations that regulators trust. Discover the Finanta difference for exception tracking that turns compliance into a competitive advantage.

Manual exception tracking, spreadsheet-based tickler lists, and inconsistent policy enforcement continue to slow down lenders and expose them to audit risk. Finanta’s Exception Tracking & Tickler Management eliminates these inefficiencies — automating exception capture, reminders, and approvals while ensuring full visibility and accountability across the lending lifecycle. Disconnected systems, fragmented records, and ad hoc governance structures make it difficult for institutions to maintain control. Finanta unifies exception tracking, borrower collaboration, and audit workflows into one intelligent, compliant ecosystem — keeping your team focused on lending, not chasing documents.

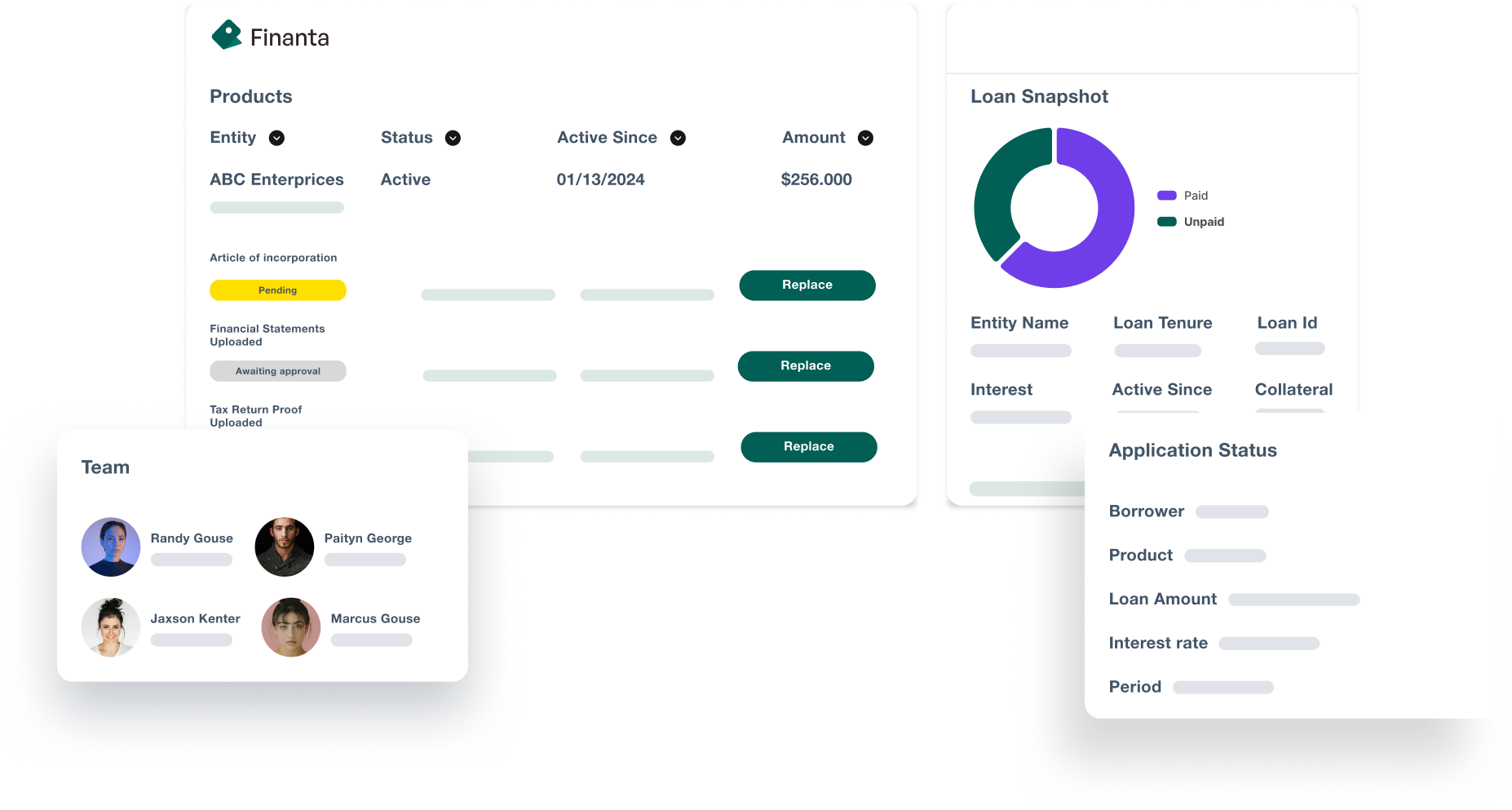

Unified Tracking Workspace

Centralize every exception, waiver, and covenant breach in one place.

Gain real-time visibility across borrowers, portfolios, and document types with smart filters, color-coded statuses, and SLA-based prioritization — so nothing slips through the cracks.

Automated Alerts and SLA Management

Never miss a compliance deadline again.

Finanta automates reminder cadences (T-14 / T-7 / T-3 / T-1) and escalates overdue items instantly, ensuring every stakeholder stays informed and accountable.

Governance, Compliance & Risk Control

Make every waiver traceable and every audit defensible.

Mandatory reason codes, approval routing, and immutable audit logs guarantee full oversight and regulatory confidence across all exceptions and deferrals.

Smart Creation & Validation

Eliminate setup errors and standardize processes from day one. Prefilled borrower data, configurable rule dictionaries, and covenant-based validation logic ensure consistent, error-free exception tracking across your portfolio.

Borrower Collaboration & Document Exchange

Collect documents without the back-and-forth. Borrowers can securely upload, acknowledge, and communicate directly within Finanta’s borrower portal — reducing follow-ups and improving response times.

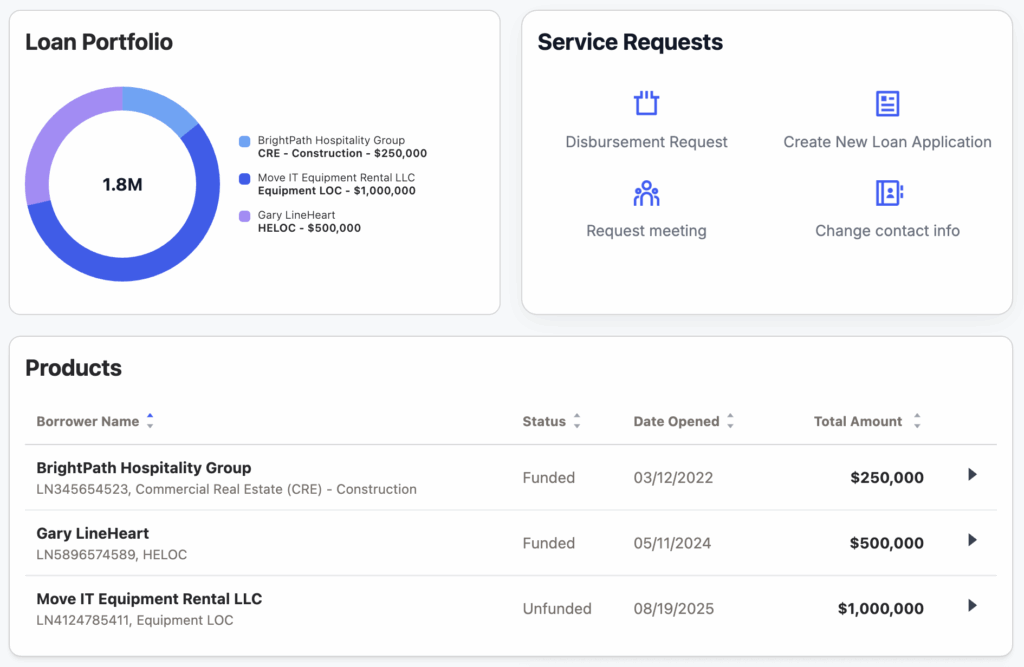

Analytics & Reporting Dashboards

Know your exceptions before your examiners do. Visualize portfolio health, covenant compliance, and exception trends in real time with customizable dashboards, heatmaps, and one-click examiner exports.

Integration Ecosystem

Seamlessly fits your existing tech stack.

Finanta integrates with leading core systems (FIS, Fiserv, Precision) and DMS solutions (Hyland, DocuSign, Laserfiche), ensuring end-to-end visibility without reengineering your workflows.

Spreadsheets and shared drives make version control and updates unreliable. Finanta’s unified workspace keeps all records current, consistent, and audit-ready.

Unstructured waiver approvals and manual judgment calls increase operational risk. Finanta enforces policy-driven workflows and transparent review chains.

Executives often see exception data only during exams. Finanta provides continuous dashboards and proactive alerts to surface issues before they escalate.

Servicing teams spend hours chasing borrowers or reconciling ticklers. Finanta automates alerts, reminders, and document collection — freeing your team’s time for strategic work.

Branches and products often track differently. Finanta standardizes frameworks and taxonomies so exception data can be aggregated institution-wide for compliance and risk reporting.

Embrace a smarter, automated approach to exception tracking and tickler management. Finanta empowers lenders to eliminate manual risk, improve compliance readiness, and deliver a seamless audit experience — all while increasing operational efficiency.

Finanta revolutionizes loan origination by streamlining client inquiries and pre-qualification, while automating application processes for a global lending solutions.

Finanta transforms loan approvals by seamlessly compiling and presenting loan proposals using advanced digital tools for informed decision-making.

Finanta ensures impeccable compliance with automated KYC and anti-money laundering systems, adhering to regulatory and internal policies effortlessly.

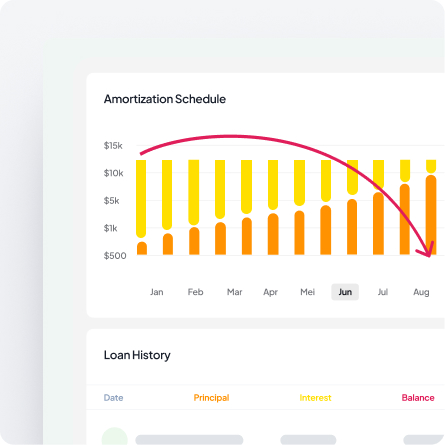

Revitalize loan servicing with Finanta’s efficient fund disbursement, real-time payment monitoring, and enhanced customer support through a comprehensive digital approach.

Finanta excels in loan portfolio management by offering advanced tools for performance monitoring, risk management, and adaptive portfolio restructuring.

Finanta secures assets and collateral through rigorous valuation and management, ensuring legal compliance and asset integrity throughout the loan term.

Finanta unlocks business insights with customizable reporting and advanced analytics, integrating with BI tools for comprehensive loan performance and market analysis.

Finanta amplifies lending operations with smart third-party integrations and fintech collaborations, leveraging advanced technologies for a competitive edge.

“By leveraging Finanta’s comprehensive commercial lending solutions suite, IBC Bank will not only enhance their operational efficiencies but also provide their clients with superior lending products and services tailored to the dynamic commercial lending sector.”

Finanta automates the entire reminder process with smart alert cadences (T-14, T-7, T-3, and T-1 day notifications) to keep your team ahead of deadlines. The system also features SLA-based prioritization with color-coded statuses, automatically escalating overdue items to the appropriate stakeholders. Real-time dashboards provide instant visibility into portfolio health and covenant compliance, so you can identify potential issues before they become audit concerns. This proactive approach eliminates the risk of manual tracking errors and ensures every exception, waiver, and covenant breach is addressed on time.

Yes, Finanta seamlessly integrates with leading core banking systems including FIS, Fiserv, and Precision, as well as major document management solutions like Hyland, DocuSign, and Laserfiche. This means you don’t need to reengineer your existing workflows or replace your current technology stack. Finanta acts as a unified layer that connects your systems, providing end-to-end visibility and eliminating data silos while maintaining all your established processes and vendor relationships.

Finanta includes a secure borrower portal that eliminates the back-and-forth typically involved in document collection. Borrowers can directly upload required documents, acknowledge receipt of requests, and communicate with your team within a single platform. The system automatically sends reminders to borrowers based on your configured schedules, tracks document submission status in real-time, and notifies your team when items are received. This streamlined approach significantly reduces follow-up time, improves response rates, and frees your servicing team to focus on more strategic activities rather than chasing paperwork.