Maximize performance and minimize risk with Finanta’s comprehensive Loan Portfolio Management—where insight meets foresight in commercial lending.

Finanta’s Loan Portfolio Management streamlines the complexity of commercial lending. It offers lenders a comprehensive solution for strategic portfolio optimization, enabling detailed analysis, efficient risk management, and performance tracking across all loans.

Obtain a 360-degree perspective of the relationship with each borrower, with detailed demographic, financial, and risk data, all contributing to a more informed lending strategy.

Monitor delinquency trends, charge-off rates, and concentration risk while maintaining regulatory compliance with automated exception reporting and aging analysis across all lending products

Streamline lending operations with funnel analysis, cycle time tracking, conversion rate monitoring, and SLA performance metrics to maximize efficiency from application to funding.

deep insights into portfolio balance, utilization rates, LTV ratios, and product diversification with trend analysis and concentration monitoring across across geographies and lending segments.

Advance Risk Analysis

Our system is engineered to conduct a profound risk analysis, ensuring that lenders can foresee and forestall potential losses while maintaining the health of their loan portfolio.

Real-Time Loan Performance Monitoring

Stay ahead with real-time insights into your loan portfolio’s health. Finanta’s live monitoring capabilities enable lenders to make swift, data-driven decisions, ensuring a proactive stance in portfolio management.

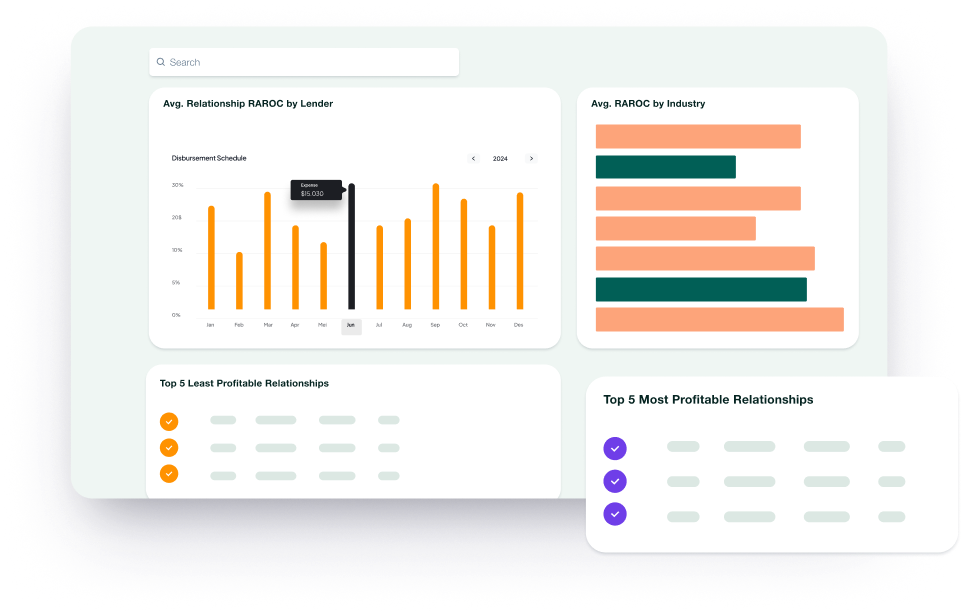

Portfolio Profitability Analytics

Real-time profitability analytics dashboard tracking core lending metrics including net interest margins, ROA, loan growth rates, and yield pricing across commercial lending portfolios.

Portfolio Composition Analytics

Portfolio analytics dashboard providing real-time insights into loan composition, utilization rates, LTV ratios, and concentration across industries with trend analysis monitoring.

Cross-Selling and Customer Retention Strategies

Utilize contextual data for a deep understanding of your borrowers, revealing opportunities for cross-selling and upselling. With Finanta, drive revenue growth while enhancing the borrower’s experience and satisfaction with value-added services.

Continuously evaluate your loan portfolio with Finanta’s analytical tools. Regular valuation is not a mere regulatory tick-box but a strategic endeavor, crucial for accurate reporting, stakeholder communication, and informed decision-making.

Prepare for any economic condition with Finanta’s dashboards and data insights that help in stress testing and scenario analysis. Assess the impact of various market conditions on your portfolio to identify vulnerabilities early and devise robust risk mitigation strategies.

Maintain the highest standards of loan integrity and operational effectiveness with Finanta’s periodic loan review and auditing capabilities, ensuring adherence to internal controls and regulatory requirements.

Craft effective workout and restructuring plans for non-performing assets. Finanta’s strategic tools help recover maximum value, mitigating risk and enhancing portfolio resilience.

With Finanta, manage the sensitivity of your portfolio to interest fluctuations. Effective interest rate risk management is essential for safeguarding profitability and ensuring longterm stability.

Finanta’s Loan Portfolio Management streamlines commercial lending, offering tools for growth, risk management, and enhanced borrower engagement—unlocking new possibilities in portfolio optimization.

Finanta revolutionizes loan origination by streamlining client inquiries and pre-qualification, while automating application processes for a global lending solutions.

Finanta transforms loan approvals by seamlessly compiling and presenting loan proposals using advanced digital tools for informed decision-making.

Finanta ensures impeccable compliance with automated KYC and anti-money laundering systems, adhering to regulatory and internal policies effortlessly.

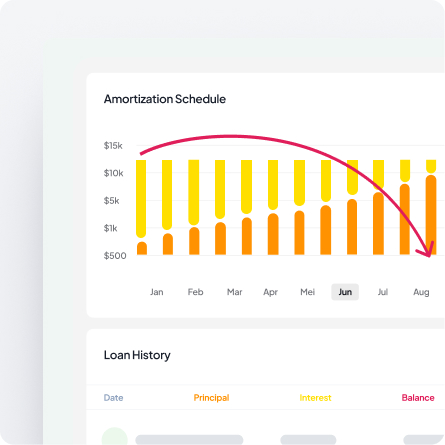

Revitalize loan servicing with Finanta’s efficient fund disbursement, real-time payment monitoring, and enhanced customer support through a comprehensive digital approach.

Finanta excels in loan portfolio management by offering advanced tools for performance monitoring, risk management, and adaptive portfolio restructuring.

Finanta secures assets and collateral through rigorous valuation and management, ensuring legal compliance and asset integrity throughout the loan term.

Finanta unlocks business insights with customizable reporting and advanced analytics, integrating with BI tools for comprehensive loan performance and market analysis.

Finanta amplifies lending operations with smart third-party integrations and fintech collaborations, leveraging advanced technologies for a competitive edge.

“By leveraging Finanta’s comprehensive commercial lending solutions suite, IBC Bank will not only enhance their operational efficiencies but also provide their clients with superior lending products and services tailored to the dynamic commercial lending sector.”

Finanta provides a comprehensive 360-degree view of your entire loan portfolio, including detailed borrower demographics, financial health metrics, relationship history, and risk profiles. The platform enables real-time analysis of balance sheets, P&L statements, financial ratios, and performance trends across all loans, giving you the strategic insights needed to optimize portfolio performance and make informed lending decisions.

Finanta offers robust risk analysis and credit scoring capabilities that help you identify, assess, and mitigate potential risks effectively. The platform continuously monitors portfolio health, flags high-risk loans, tracks concentration risks, and provides early warning indicators. This proactive approach enables you to take preventive action before issues escalate, protecting your portfolio’s overall health.

Yes. Finanta keeps your portfolio aligned with the ever-changing regulatory landscape by automatically monitoring compliance with current standards and regulations. The platform provides audit trails, compliance reporting, and alerts for regulatory requirements, ensuring your entire portfolio adheres to the latest lending regulations and industry standards without manual oversight.