Maximize efficiency and customer satisfaction in your loan portfolio with Finanta’s innovative Loan Servicing tools, designed for the modern lender.

Finanta revolutionizes the commercial lending cycle with a focus on efficiency, adaptability, and client success. Our Loan Servicing module streamlines post-origination management, ensuring consistent lender-borrower engagement and the agility to meet evolving financial demands with robust reliability.

Finanta's Digital Credit Presentation feature comes equipped with standardized templates that streamline the creation of compelling loan narratives, ensuring consistency and clarity in every credit presentation.

With Finanta, borrowers receive timely reminders and statements, fostering a proactive communication ecosystem that upholds payment discipline and nurtures lender-borrower rapport.

Our system dynamically responds to change, managing loan modifications and renewals with the finesse required for both lender benefit and borrower satisfaction.

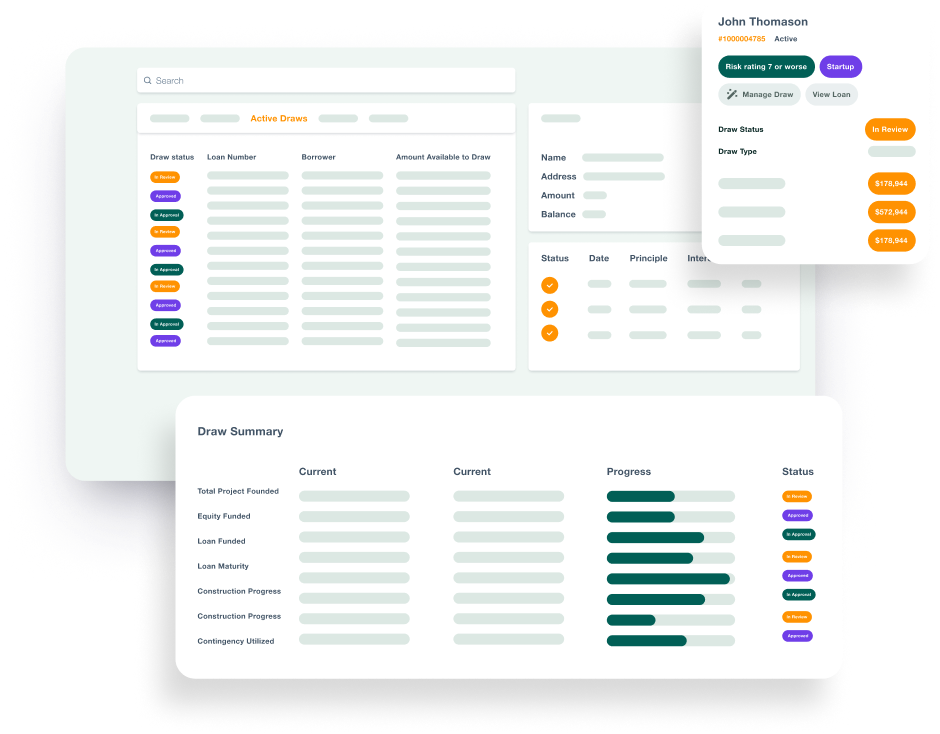

Finanta's platform offers a comprehensive suite of tools for detailed monitoring and reporting on loan performance, ensuring lenders have a full spectrum view of their portfolio's health.

Dynamic Draw Schedules & Request Management

Finanta’s platform ensures a transparent, efficient draw and disbursement process, aligning fund releases with project progress and budgetary controls.

Exception Handling with Finesse

Keep a vigilant eye on collateral values and statuses, and harness advanced reporting tools for strategic insights that drive informed decision-making and portfolio growth.

Flexibility in Loan Management

Finanta champions adaptability, providing lenders the tools to respond to borrower circumstances with loan modifications and restructuring, crafted for resilience and risk management.

Borrower Empowerment

The customer portal is a gateway to empowerment, offering borrowers transparency, control, and the confidence to manage their loans with autonomy.

Finanta’s Loan Servicing module reimagines borrower interactions, creating a truly digital, 360-degree experience that places customer satisfaction at the heart of every transaction. Our comprehensive customer management system not only streamlines loan disbursement but also crafts a journey of transparency, responsiveness, and personalized service.

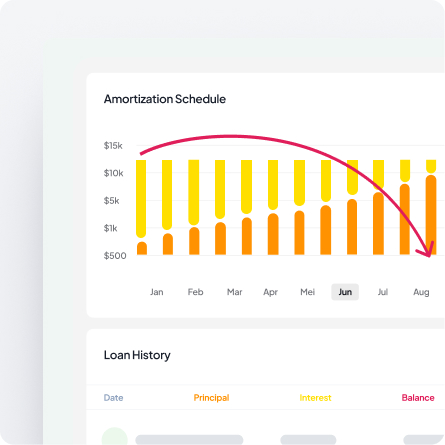

A central hub where borrowers can manage their loans, view amortization schedules, and communicate with lenders, delivering a cohesive and empowering user experience.

Leveraging Open Banking APIs, Finanta enriches the lender’s understanding of each borrower, enabling personalized loan terms and targeted communication that resonates with the borrower’s unique financial narrative

Agile adjustment of loan terms based on real-time borrower evaluations and changing market conditions, balancing borrower needs with portfolio risk.

A central hub where borrowers can manage their loans, view amortization schedules, and communicate with lenders, delivering a cohesive and empowering user experience.

Leveraging Open Banking APIs, Finanta enriches the lender’s understanding of each borrower, enabling personalized loan terms and targeted communication that resonates with the borrower’s unique financial narrative

Ongoing surveillance of credit risk post-funding, providing lenders with the insights needed to anticipate and mitigate potential issues before they arise.

Finanta’s Loan Servicing module is designed not just to meet but to exceed the evolving demands of commercial lending. From initial disbursement to the final payment, and through every modification in between, Finanta ensures that every step is taken with precision, foresight, and the ultimate goal of fostering lasting customer relationships and financial success.

Finanta revolutionizes loan origination by streamlining client inquiries and pre-qualification, while automating application processes for a global lending solutions.

Finanta transforms loan approvals by seamlessly compiling and presenting loan proposals using advanced digital tools for informed decision-making.

Finanta ensures impeccable compliance with automated KYC and anti-money laundering systems, adhering to regulatory and internal policies effortlessly.

Revitalize loan servicing with Finanta’s efficient fund disbursement, real-time payment monitoring, and enhanced customer support through a comprehensive digital approach.

Finanta excels in loan portfolio management by offering advanced tools for performance monitoring, risk management, and adaptive portfolio restructuring.

Finanta secures assets and collateral through rigorous valuation and management, ensuring legal compliance and asset integrity throughout the loan term.

Finanta unlocks business insights with customizable reporting and advanced analytics, integrating with BI tools for comprehensive loan performance and market analysis.

Finanta amplifies lending operations with smart third-party integrations and fintech collaborations, leveraging advanced technologies for a competitive edge.

“By leveraging Finanta’s comprehensive commercial lending solutions suite, IBC Bank will not only enhance their operational efficiencies but also provide their clients with superior lending products and services tailored to the dynamic commercial lending sector.”

Finanta’s Loan Servicing module manages the entire post-origination lifecycle of your commercial loans. This includes automated payment processing, loan disbursement, ongoing borrower communications, payment reminders, statement generation, loan modifications and renewals, performance monitoring, and comprehensive portfolio reporting. Our platform ensures every aspect of loan servicing is handled efficiently from the first disbursement to the final payment.

Finanta creates a proactive communication ecosystem through automated, timely reminders and statements that keep borrowers informed and engaged. The platform provides a 360-degree digital experience with transparency at every touchpoint, fostering payment discipline and strengthening lender-borrower relationships. Borrowers receive personalized service and real-time access to their loan information, significantly improving satisfaction and retention.

Yes. Finanta’s system dynamically manages loan modifications and renewals with precision and flexibility. The platform streamlines the entire modification process, balancing lender requirements with borrower needs while maintaining compliance. Whether it’s adjusting payment terms, extending loan periods, or processing renewals, Finanta handles these changes seamlessly, reducing administrative burden and ensuring borrower satisfaction.